Despite economic challenges, mergers and acquisitions (M&As) in the U.S. business sector have surged. Companies are leveraging strategic deals to enhance market presence, expand operations, and drive growth in a volatile economic landscape

Despite inflation concerns, rising interest rates, and market volatility, U.S. businesses are actively pursuing mergers and acquisitions (M&As) as a strategic growth tool. In recent months, deal-making activity has accelerated across various sectors, including technology, healthcare, finance, and manufacturing. Industry leaders see M&As as a pathway to expansion, cost efficiency, and competitive positioning amid uncertain economic conditions.

Key Factors Driving M&A Activity

Several factors contribute to the rising number of mergers and acquisitions in the U.S.:

✅

Market Consolidation: Companies are acquiring competitors to strengthen their market position.

✅

Strategic Expansion: Businesses seek to diversify offerings and expand into new markets.

✅

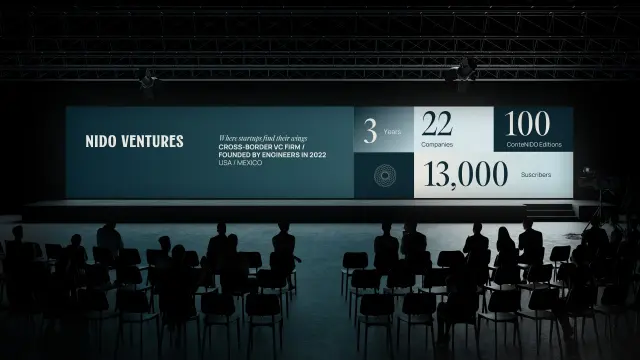

Private Equity Investment: Increased funding from private equity firms fuels large-scale acquisitions.

✅

Technology Integration: Companies invest in tech-driven firms to accelerate digital transformation.

✅

Lower Valuations: Market downturns have made some businesses more attractive for acquisition.

Major Sectors Experiencing High M&A Activity

Several industries have seen an uptick in M&A deals:

- Technology: Tech firms are acquiring startups to strengthen innovation and AI capabilities.

- Healthcare & Pharmaceuticals: Companies are merging to enhance research, drug development, and medical services.

- Financial Services: Banks and fintech firms are consolidating to improve digital banking solutions.

- Manufacturing & Retail: Businesses are merging to optimize supply chains and production.

Challenges and Risks in M&A Transactions

While M&As present significant opportunities, they also come with risks:

❌

Regulatory Scrutiny: Antitrust concerns may lead to regulatory challenges.

❌

Market Uncertainty: Economic fluctuations can impact deal valuations.

❌

Integration Issues: Merging corporate cultures and operations can be complex.

❌

Debt Financing: High-interest rates make deal financing more expensive.

Future Outlook for M&As in the U.S.

Despite economic headwinds, M&A activity is expected to remain strong as businesses prioritize strategic growth, efficiency, and resilience. Companies will continue to seek opportunities to expand operations and enhance competitive advantages through well-planned acquisitions.