Explore how U.S. investment policies impact business success. Learn how to navigate key regulations, tax incentives, and funding opportunities to maximize growth potential

A Guide to Understanding U.S. Investment Policies for Business Growth

U.S. investment policies play a critical role in shaping the growth and success of businesses across various sectors. These policies are designed to promote economic growth, create jobs, and encourage innovation. However, they also come with complexities that businesses must navigate to thrive. This article explores how understanding and leveraging U.S. investment policies can help businesses unlock growth opportunities, reduce risks, and maximize their success in a rapidly evolving economic landscape.

1. Understanding Key U.S. Investment Policies

The U.S. government implements various policies to guide business investment decisions. These policies encompass tax incentives, trade regulations, funding opportunities, and sustainability measures. Business leaders must understand how these policies can work to their advantage.

Tax Policies and Incentives

One of the most significant factors influencing business success in the U.S. is the tax policy. The government offers several tax incentives to encourage investment in specific industries and regions.

- Corporate Tax Rates: The reduction of corporate tax rates to 21% under the Tax Cuts and Jobs Act (TCJA) has made the U.S. an attractive destination for business investment. Companies can reinvest savings into operations, research, and expansion, stimulating growth.

- Tax Credits for Innovation: U.S. investment policies often provide tax credits for research and development (R&D), encouraging businesses to invest in innovation. This is particularly important for companies in high-tech industries such as AI, biotech, and renewable energy.

- Opportunity Zones: The introduction of Opportunity Zones offers businesses tax breaks for investing in economically distressed areas. These areas often have untapped growth potential, and businesses can benefit from both financial incentives and access to new markets.

Regulatory and Trade Policies

Trade policies and regulations shape how businesses can interact with international markets and supply chains.

- Trade Agreements: U.S. trade agreements like the U.S.-Mexico-Canada Agreement (USMCA) open up new opportunities for cross-border business activities. Companies can expand their markets, lower tariffs, and increase profitability through international trade.

- Intellectual Property Protections: The U.S. has strong intellectual property (IP) laws that protect business innovations, patents, and trademarks. Understanding IP laws can help businesses safeguard their ideas and products, ensuring a competitive advantage in the market.

- Regulatory Compliance: Adhering to federal, state, and local regulations is crucial for business success. Investment policies designed to support compliance with environmental, health, and safety standards help businesses avoid costly fines and reputational damage.

2. Accessing Capital and Investment Funding

For businesses to grow and succeed, they need access to capital. U.S. investment policies provide various funding opportunities for businesses of all sizes, from startups to large corporations.

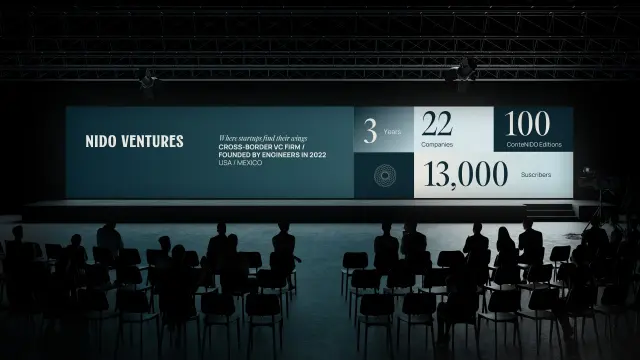

Venture Capital and Private Equity

Investment policies in the U.S. create a thriving venture capital (VC) and private equity (PE) ecosystem. The government supports these investment avenues by offering tax incentives and fostering a business-friendly environment for investors.

- Tax Benefits for Venture Capitalists: The U.S. tax code allows VC firms and angel investors to benefit from tax breaks, making it easier to fund new and innovative startups.

- Private Equity Investment: U.S. policies encourage private equity investment by providing favorable tax treatments, enabling businesses to raise capital from institutional investors. These investments can help companies scale operations, enter new markets, and achieve long-term growth.

Small Business Administration (SBA) Loans

The U.S. government offers funding through the Small Business Administration (SBA) for businesses that meet specific criteria. SBA loans are attractive due to their low interest rates, flexible repayment terms, and low down payments. These loans are ideal for small businesses looking to expand or invest in new technology and infrastructure.

Crowdfunding and Alternative Financing

With the rise of digital platforms, businesses can now raise funds through crowdfunding and alternative financing models. U.S. investment policies have made it easier for businesses to access capital from a wider pool of investors.

- Equity Crowdfunding: Under the Jumpstart Our Business Startups (JOBS) Act, businesses can raise capital from individual investors through online platforms. This has democratized access to funding for startups and small businesses.

- Debt Crowdfunding: U.S. policies have also facilitated debt crowdfunding, where businesses can raise capital through peer-to-peer lending. This allows companies to access loans without going through traditional financial institutions.

3. Leveraging Sustainability and ESG Policies

In today’s business landscape, sustainability is not just a buzzword—it’s a critical component of investment strategies. U.S. investment policies encourage businesses to adopt environmentally and socially responsible practices, creating new opportunities for growth.

Opportunities in Green Investment

The U.S. government provides tax incentives, grants, and subsidies for businesses investing in green technologies and sustainable practices.

- Renewable Energy Incentives: Policies such as tax credits for solar, wind, and other renewable energy projects help businesses transition to greener energy sources, reducing their carbon footprint and operating costs.

- Green Bonds: Businesses can issue green bonds to finance eco-friendly projects. U.S. policies are encouraging the growth of green bonds, which are an attractive investment option for socially responsible investors.

ESG Investing and Corporate Responsibility

Environmental, social, and governance (ESG) investing is gaining momentum in the U.S., and businesses that prioritize ESG principles are likely to attract investment.

- ESG Reporting: U.S. policies are pushing businesses to report on their ESG practices. By adhering to ESG standards, businesses can improve their reputation, attract ethical investors, and enhance their long-term profitability.

- Social Impact Investing: Investors are increasingly interested in companies that create positive social impact, such as those that focus on diversity and inclusion, community development, and fair labor practices. Businesses that align with these values can tap into a growing pool of impact investors.

4. Managing Risks in a Dynamic Investment Landscape

While U.S. investment policies offer significant opportunities, businesses must also be prepared to navigate potential risks. Understanding the risks associated with regulatory changes, market volatility, and economic cycles is essential for long-term success.

Economic and Market Volatility

U.S. investment policies are designed to stabilize financial markets, but businesses still face risks from economic downturns and market fluctuations.

- Interest Rate Hikes: Changes in Federal Reserve policies, such as interest rate hikes, can increase borrowing costs and reduce consumer spending, affecting business profitability.

- Inflation Risks: Rising inflation can erode purchasing power and increase operational costs, particularly for businesses reliant on raw materials and labor.

Global Economic and Geopolitical Risks

Trade wars, tariffs, and political instability in other countries can affect U.S. businesses operating in global markets.

- Global Supply Chain Disruptions: U.S. businesses with international supply chains must monitor geopolitical risks and trade policies that could disrupt operations and increase costs.

- Tariffs and Trade Barriers: Changes in trade policy, such as the imposition of tariffs, can impact business profitability, especially for companies that rely on imports and exports.

5. The Importance of Staying Informed and Adapting to Change

To succeed in the complex U.S. investment landscape, businesses must remain adaptable and stay informed about changes in policies, regulations, and market conditions. Regularly reviewing investment strategies, consulting with financial advisors, and engaging in continuous learning will help businesses navigate the evolving economic environment